Deft dETF

Crypto SaaS AKA "How to Lose (less) Friends & Alienate (less) People"

ETFs for Crypto

When I was working on decrypto with my students we had the idea for an analog of SPY but for crypto. We wanted to learn more about smart contracts and try to implement assets that were baskets of other assets, something that would provide index functionality to crypto markets.

We thought of a couple ways this could be done relatively soon -

- A simple system reusing Decrypto AutoBuyer could buy a basket of the top 20 cryptos and auto adjust itself to maintain the basket. This would allow us as the users to have a simple way to diversify and reduce portfolio risk - but it was little more than an automated portfolio rebalancer.

- A more complex on chain system could be implemented in the form of a smart contract, so that it would represent an asset on its own, IE an on chain ETF. This would allow for more complex functionality, however it would be limited to systems built with smart contracts in mind and you could only really have that ETF asset span the ecosystem it was built upon (EG ERC20 tokens on Ethereum).

The latter would require exciting things like oracles to feed in market cap data and some opportunity to write actual smart contracts which we’d never done. The former however was good for making money in the short term. We decided to prioritize the automated portfolio manager solution for PoC as we were still testing the AutoBuyer API system in Decrypto.

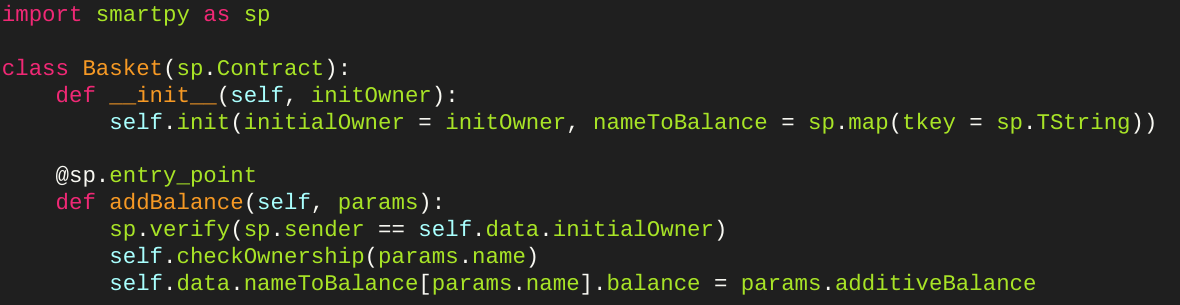

After we made that stable we were going to move onto learning SmartPy to try and write out more of the longer term idea.

The Results?

There were’t many, truth be told. We played around with this as a test of the AutoBuyer and it was nice for that, we were able to keep a portfolio rebalanced easily according to top 20 coins by share of market cap. A big issue was trade commissions - rebalancing cost more money than we made because a good number of those top 20 coins were high volatility and without intelligence features it would be folly to actively manage assets that swing so hard.

A happy medium rule of thumb was to rebalance manually and less frequently. We kind of “rediscovered” the efficient markets hypothesis in this way because we definitely found active management to be less useful than we thought.

Another thing of consequence I would say, is that we learned writing smart contracts is hard. We never quite got there but the idea was exciting. We looked into using atomic swaps and other advancements in the Web 3.0 space to make a true ETF that could hold a basket of assets across chains, but we never got there.